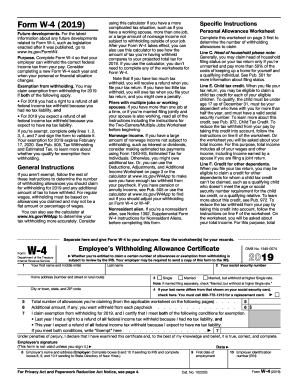

Youre allowed an additional deduction for blindness if youre blind on the last day of the tax year. Blind taxpayers get the same standard deductions as.

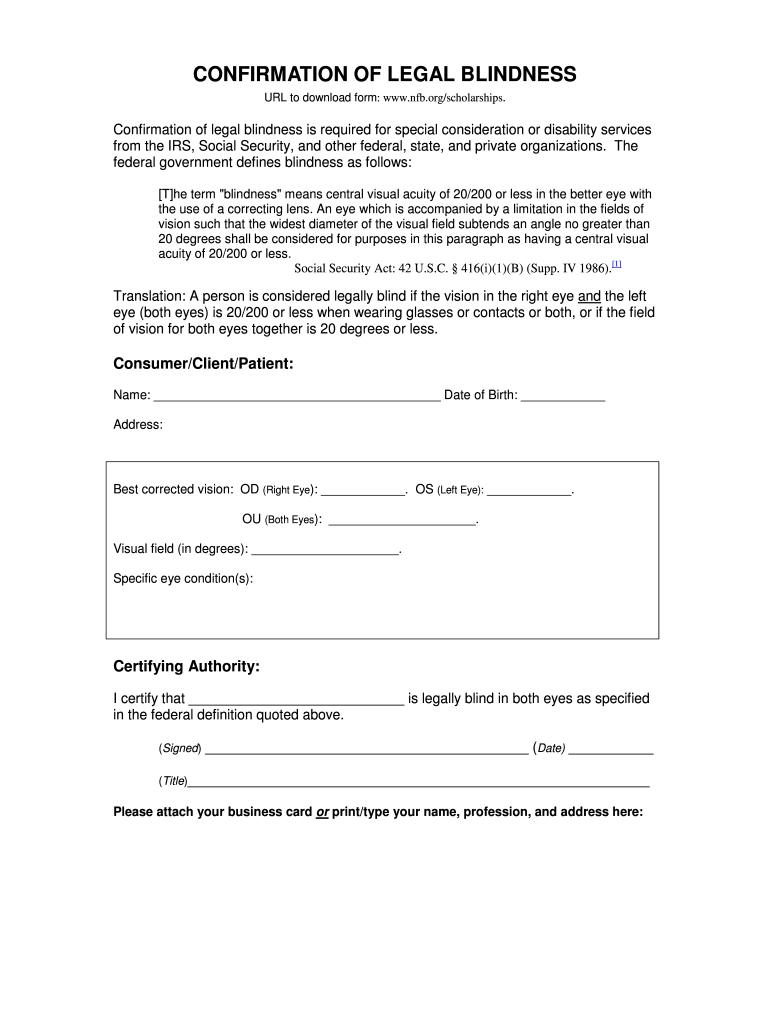

Https Kcc Ky Gov Vocational Rehabilitation Blind 20services Documents Confirmation 20of 20legal 20blindness Pdf

Irs Definition Of Legally Blind By.

Irs legally blind. People ages 65 and older also qualify for a similar tax deduction. Are legally blind refer to Publication 501 Exemptions Standard Deduction and Filing Information PDF. The IRS offers two ways to qualify for the Credit for the Elderly and the Disabled.

Resources for those who are legally blind Legal blindness can make people eligible for special services and assistance. Legally blind vision loss can result from either diabetic retinopathy or macular degeneration. For example a single taxpayer who is age 65 and blind would be entitled to a basic standard deduction and an additional standard deduction equal to the sum of the additional amounts for both age and blindness.

When you file your tax return the Internal Revenue Service will know your age and whether or not youre legally blind. Legal blindness is defined by the Internal Revenue Service as a visual field of less than 20 degrees or vision that cannot be corrected to 20200 in the better eye with corrective lenses. Depending on the one that applies youll get 1350 or 1600 more in your standard deduction.

Or have a disability that forced you to retire before your employers mandatory retirement age usually age 65. Wednesday 27 January 2021 Add Comment Edit. 1650 for single or head of household filers.

To qualify as disabled you also need to have taxable disability income such as Social Security disability benefits. The Social Security Administration provides benefits to the legally blind. States and federal taxing authorities also allow tax deductions.

Legally blind or partially sighted individuals can still see whereas completely blind patients see nothing. Understand what is considered legally blind. Its not a functional low vision definition and doesnt tell us very much at all about what a person can and cannot see.

That means your vision is not correctable to at least 20200 in your best eye or you have a visual field of 20 degrees or less in the better eye. Legal blindness is a definition used by the United States government to determine eligibility for vocational training rehabilitation schooling disability benefits low vision devices and tax exemption programs. Someone who is legally blind would be able to read only the top line of the chart a capital E while wearing corrective lenses.

There are also tests that can measure in between 20200 and 20100. We tend to think of blindness as total blindness but there are varying degrees of blindness that are legally defined to. The IRS offers free.

Someone who cannot view the line for 20100 but sees somewhere between 20100 and 20200 would still meet the governments standard of legal. Legally blind or partially sighted individuals can still see whereas completely blind patients see nothing. The line below the big E is the line for 20100.

The Social Security Administration defines the term legally blind as. The IRS defines legal blindness as being unable to see better than 20200 in your better eye even with corrective eyeglasses or contacts or having a field of vision less than 20 degrees. To qualify for federal benefits as a blind individual you must be legally blind.

Blind or low vision individuals might qualify for one of. Federal definition 10 of blindness in the Supplemental Security Incomeprogram under Title XVI of the Social Security Act currently states. Vision that cant be corrected to better than 20200 in your better eye or if your visual field is 20 degrees or less in your better eye for a period that lasted or is expected to last at least 12 months Medicare for People on Social Security Disability.

You might qualify for state benefits even if youre ineligible for federal benefits. Had gross income refer to Publication 525 Taxable and Nontaxable Information to see. Complete blindness can result diabetic retinopathy but not ARMD.

1300 for married couples filing jointly or separately with one blind spouse. Be at least 65 years old. Sure you can itemize deductions but when.

For the definition of blindness refer to. For the 2020 tax year the legally blind tax deduction is. This credit reduces the amount of tax owed to the IRS.

Whose lack of vision qualifies them for a special tax deduction accorded to blind persons. 2 An individual shall be considered to be blind for purposes of this title if he has central. 2600 for married couples filing jointly with two blind spouses.

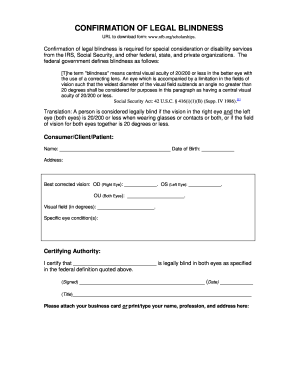

CONFIRMATION OF LEGAL BLINDNESS. Liability For Nonprofit Board Members And Irs Regulations The Standard Tax Deduction How It Works And How To Use It Irs Archives The National Law Forum Tax Deductions What Are They And How Do They Work 1 Taxes Welcome Conejo Valley Guide Conejo Valley Events What Is Considered Legally Blind Legal. If youre blind and over 65 you can stack these deductions and qualify for both.

This increase in the standard deduction for legally blind and elderly is a major consideration for claiming the standard deduction. A blind taxpayer is any individual in the US. Legal Blindness and the IRS Legally blind vision loss can result from either diabetic retinopathy or macular degeneration.

Complete blindness can result diabetic retinopathy but not ARMD. To see if you qualify for an increased standard deduction.

Https Www Irs Gov Pub Irs Utl Oc Irsoffersassistanceforpeoplewithdisabilitiesfinal Pdf

Blind Taxpayers Sue The Irs Disability Rights California

/cdn.vox-cdn.com/uploads/chorus_asset/file/19650805/AdobeStock_314166542.jpeg)

Taxes 2020 When To File What Changes To Expect With Deductions Tax Breaks Chicago Sun Times

Irs Legally Blind Form Fill Online Printable Fillable Blank Pdffiller

Irs Federal Standard Tax Deductions For 2020 And 2021

Irs Legally Blind Form Fill Online Printable Fillable Blank Pdffiller

Special Deductions Available For Elderly And Blind Filers

Willful Blindness Closed Your Eyes To Fbar Requirements

Tax Honesty The 1040 Type Of Tax

Irs Legally Blind Form Fill Online Printable Fillable Blank Pdffiller

Irs Supplies Tax Resources For The Blind Visually Impaired

Irs Legally Blind Form Fill Online Printable Fillable Blank Pdffiller

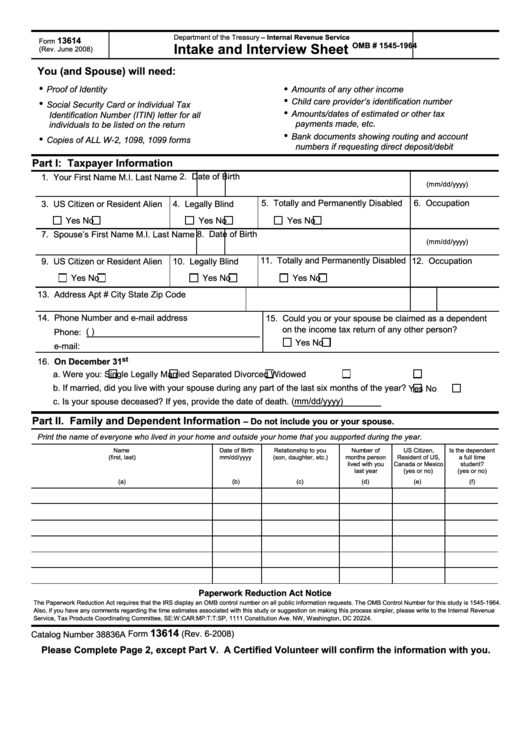

Fillable Form 13614 6 8 Intake And Interview Sheet Department Of The Treasury Printable Pdf Download

Being Blind Is Expensive There S A Unique Tax Deduction That Can Help Lighthouse Central Florida

Tax Season 2020 Your Top 10 Rights As A Taxpayer Masslive Com

Irs Legally Blind Form Fill Online Printable Fillable Blank Pdffiller

0 komentar:

Posting Komentar